Executive Imperative: Risk Mitigation through Communication

Ujjivan Small Finance Bank (SFB) required a communication solution that guaranteed near-perfect, instant delivery of critical transactional and statutory alerts to manage regulatory risk and maintain customer trust across its Pan-India operations. The challenge was compliance, not conversion.

The Regulatory Challenge: The Cost of Failure

Operating with a large, rapidly growing customer base, Ujjivan faces continuous mandates for customer notification.

● Communication Mandates: Required instant delivery of both Transactional Alerts (deposits, withdrawals) and Statutory Alerts (interest rate changes, policy updates).

● The Risk: Any failure in delivering these messages could lead to severe non-compliance penalties from the Reserve Bank of India (RBI), significant operational errors, and irreparable damage to customer trust.

● Need: A reliable, high-speed channel capable of handling massive, recurring volume with uncompromised delivery assurance.

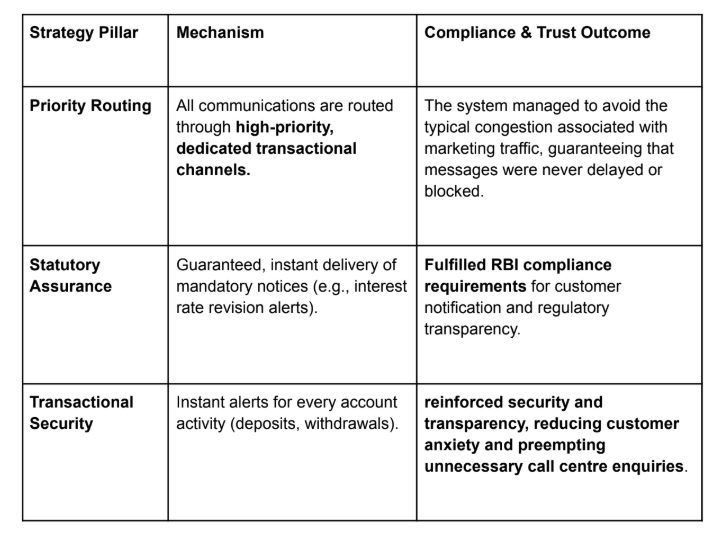

Strategic Solution: Dedicated High-Throughput Transactional SMS

Ujjivan partnered to deploy a dedicated high-throughput transactional SMS gateway. The strategy deliberately leveraged the universal reach and guaranteed delivery of SMS, which functions independently of device apps or internet connectivity—a non-negotiable requirement for critical banking alerts.

Operational Excellence & Risk Mitigation

The solution established a foundation of operational reliability, directly translating into reduced regulatory exposure and enhanced service quality.

| Performance Metric | Confidentialised Result | Strategic Risk Mitigation Impact |

| Monthly Volume Handled | Manage Multi-Million Messages Monthly | Proved the system’s scalability to handle the enormous, recurring communication needs of a rapidly expanding SFB |

| Delivery Reliability | We achieved an exemplary delivery rate of approximately 92%. | Set an industry benchmark for reliability in mass-scale transactional banking alerts, directly mitigating non-compliance risk. |

| Business Outcome | Enhanced Compliance & Customer Trust. | Near-guaranteed delivery of statutory alerts protected the bank from regulatory censure, while instant alerts reduced call centre loads and boosted customer confidence. |

Communication as Capital

Ujjivan SFB’s use of dedicated, high-reliability transactional SMS channels turns communication infrastructure into regulatory and trust capital. By achieving near-guaranteed delivery of millions of critical alerts monthly, the Bank did more than just meet the 92% delivery benchmark; it established a foundational layer of operational certainty. This strategy ensures continuous adherence to strict RBI mandates while consistently reinforcing customer confidence. In the tightly regulated financial sector, Ujjivan demonstrates that reliable communication is not a cost centre but the bedrock of regulatory stability and enduring customer transparency.

No responses yet