Executive Summary

True Credit, a leading financial services provider, successfully leveraged the WhatsApp Business API (WABA) to establish a highly secure and engaging communication channel. This initiative solved three critical business challenges—high loan application dropouts, persistent EMI defaults, and inefficient upselling—by replacing traditional outreach with targeted, real-time conversational automation. The results included a multi-fold increase in message open rates and double-digit percentage improvements in loan completion and repayment compliance.

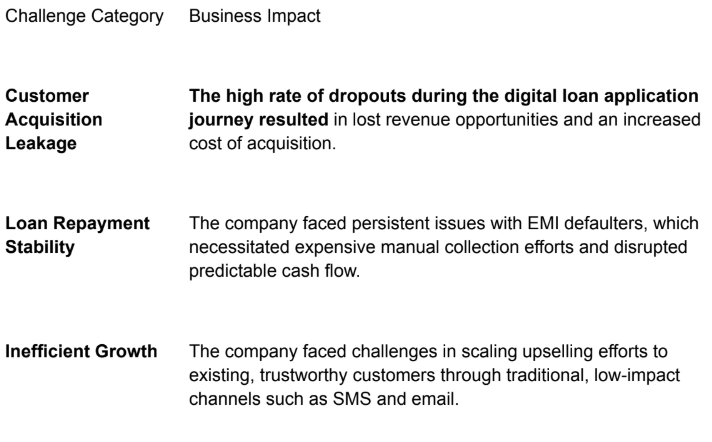

The Business Imperative

True Credit operates in the competitive personal and consumer loan market, where speed, trust, and effective recovery are vital. The company faced internal friction points that negatively impacted efficiency and growth potential:

The Core Problem: Traditional communication channels failed to deliver the necessary visibility and urgency required for time-sensitive financial alerts, resulting in low action rates and high operational expenses.

The Strategic Solution: Conversational Automation

True Credit strategically integrated the WhatsApp Business API (WABA) to move critical customer communications into a secure, high-attention environment. The solution was designed to automate engagement across the entire customer lifecycle:

A. Optimizing Customer Acquisition (Dropout Nudges)

● Action: Automated WABA messages were triggered within minutes of a customer abandoning the application midway.

● Outcome Focus: The message provided a personalized prompt and a single-tap link to resume the journey, drastically reducing application friction.

B. Securing Repayment (EMI Reminders)

● Action: Personalised, high-priority transactional/utility messages were sent a few days before the EMI due date.

● Outcome Focus: Each reminder included the exact amount, due date, and a direct, convenient payment link, ensuring maximum visibility and compliance.

C. Unlocking New Revenue (Upselling)

● Action: Targeted promotional messages were sent exclusively to customers with excellent repayment histories.

● Outcome Focus: Offers for higher credit limits or new financial products were delivered, leveraging the high trust built through the platform to drive successful cross-sell and upsell conversions.

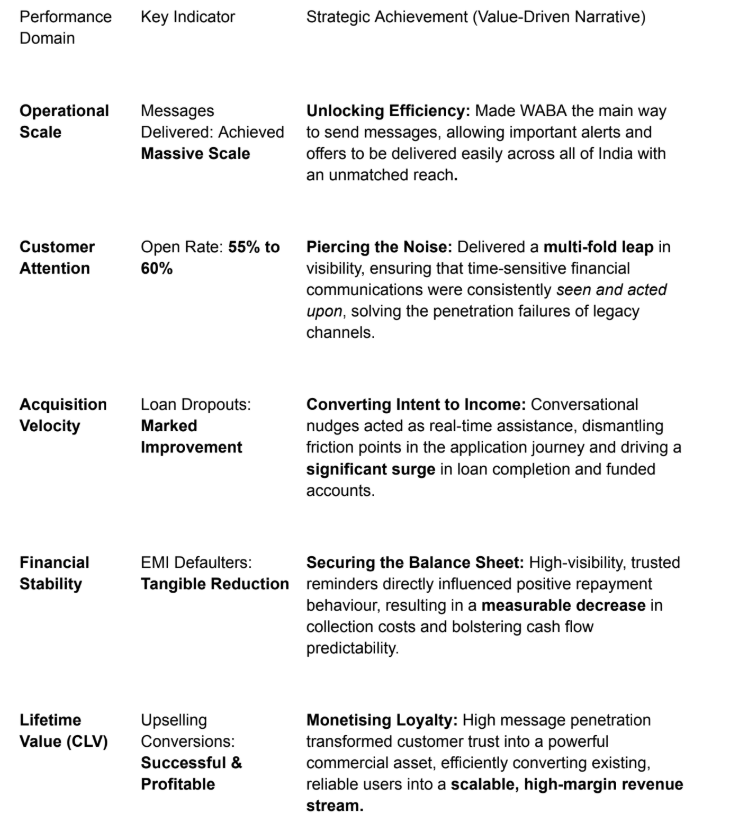

Transformational Results: The Metric of Success

The adoption of the WhatsApp Business API was not merely a channel change; it was a fundamental shift in True Credit’s operating model. The results, achieved in a short timeframe, demonstrate the platform’s unparalleled ability to drive secure, high-impact engagement.

Conclusion

By adopting the WhatsApp Business API, True Credit fundamentally reshaped its operational efficiency and customer engagement model. The exceptional engagement rates confirmed WABA’s effectiveness as a secure, personalised communication pathway. This initiative not only solved core problems—by significantly reducing application dropouts and payment defaults—but also unlocked substantial new revenue by efficiently scaling upsell conversions, making loan management more predictable and customer-centric.

No responses yet